Sound Solutions to Common Problems

Loan & Mortgage Calculator

Software Product Features

Full Control on All Installments

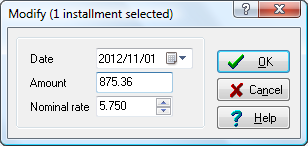

Loan & Mortgage gives you full control on all the installments in your amortization tables. This means that once an amortization table is created, you can change the date, amount and/or interest of any installments and immediately see ensuing results. For example, if a payment is late, simply change its date and Loan & Mortgage takes care of adjusting the interest calculated on that and all subsequent installments in the amortization table automatically.

Just as you can modify any installments in a table, you can also delete any of them or add new ones as needed. And again, Loan & Mortgage will take care of recalculating all the installments (interest and balance) affected by your changes.

Support for Multiple Interest Rates

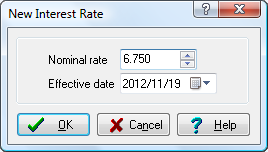

Loan & Mortgage allows you to set as many interest rates as needed on each amortization table. New interest rates can be set for any dates falling within the amortization period. To add a new interest rate to a table, simply provide the new interest rate and its effective date, and Loan & Mortgage takes care of recalculating the interest amount of all installments affected by the new interest rate. If the effective date of a new interest rate does not fall on a currently existing installment date, then a new installment is automatically created to provide an adjustment for the interest accumulated at the previous rate between the last installment date (at the previous rate) and the new interest rate effective date.

Any Combination of Installment and Compounding Frequencies

Loan & Mortgage allows you to select any combination of the following installment and interest compounding frequencies:

- Daily

- Weekly

- Bi-Weekly

- Semi-Monthly

- Monthly

- Quarterly

- Semi-Annual

- Annual

For example, you could create an amortization table with bi-weekly payments and semi-annual interest compounding.

Table Setup Templates

Loan & Mortgage allows you to save table setup entries as templates so that you can select a template instead of having to repeatedly select the same entries each time you create a new table. For example, if you need to create many amortization tables with the same installment frequency, compounding frequency, interest rate and amortization period, then you can create a template with specific values for these entries and select that template each time you want to create a new table with these (or similar) values.

You can even set one of your templates as your default table setup template so that it gets automatically loaded each time you create a new table.

Compute Unknown Value

When you create a new amortization table with Loan & Mortgage, you can enter four of the five main values of an amortization (i.e. Present Value, Future Value, Installment Amount, Nominal Rate and Amortization Duration) and Loan & Mortgage will take care of calculating the missing fifth value for you.

Personal Notes

Loan & Mortgage allows you to keep personal notes for the entire amortization table as well as each individual installment.

Customizable Table View

Loan & Mortgage allows you to select which columns you want to see in your tables and the order in which you want them to appear.

Selective Printing

Choose between printing the complete amortization table, a specific range of installments or a simple summary.

In addition to printing installments and summary information, Loan & Mortgage also allows you to print other information such as lender, borrower, notes and disclaimer information for each amortization table.

Selective Accumulations

See payment summaries (i.e. Interest Paid, Principal Paid, Total Paid) grouped by any of monthly, quarterly, semi-annual, annual and/or entire amortization periods.

Multiple Document Interface

Have any number of tables opened at the same time for convenient comparison of their contents.

Copy & Paste

Loan & Mortgage allows you to copy just about any list entries to the clipboard so they can be pasted into other applications such as Word™ or Excel™.